Expert Tax Filing & Payroll Compliance in North Carolina

When it comes to payroll, filing taxes correctly and on time is essential. At AllAboutDeposits.com, we specialize in end-to-end payroll tax filing and compliance services for North Carolina businesses. Whether you’re dealing with quarterly filings, year-end forms, or new state regulations, we ensure everything is filed accurately — and on time. Our team takes the stress out of tax compliance so you can stay focused on running your business.

How it works

Tax Strategy

We begin with a full review of your current tax filing process and compliance records. Our goal is to identify any missed deadlines, incorrect filings, or outdated systems. Then we customize a strategy to ensure your business meets all IRS and North Carolina Department of Revenue (NCDOR) requirements.

Complete Filing Support

We calculate, file, and submit all necessary payroll tax documents — including 941s, 940s, NCUI 101s, and more. Your business stays in good standing with no extra effort on your part.

Ongoing Compliance Monitoring

We track deadlines, monitor changes in NC tax laws, and update your systems as needed. No surprises, no late penalties, no stress — just clean, compliant payroll records year-round.

FAQ

Frequently Asked Questions

Do you file both federal and North Carolina payroll taxes?

Yes, we handle all payroll-related tax filings for both federal and state requirements. This includes Forms 941, 940, W-2s, 1099s, and NC-specific forms like NCUI 101 and NC-5. We also manage electronic payments, so you never miss a due date.

Can you fix past payroll tax mistakes or missed filings?

What if I already use payroll software?

Blog

Articles From Our Blog

No Tax on Tips and Credit Card Tip Coverage

The No Tax on Tips legislation represents a significant shift in federal tax policy that would…

Understanding Bank Addresses for Direct Deposit

Direct deposit has become the preferred method for receiving paychecks and other regular payments. To set…

When Do ACH Direct Deposits Post?

In today’s fast-paced financial world, understanding the intricacies of ACH direct deposits is crucial for effective…

How Does ACH Direct Deposit Work? A Comprehensive Guide

In today’s digital age, electronic payment systems have revolutionized the way we handle financial transactions. Two…

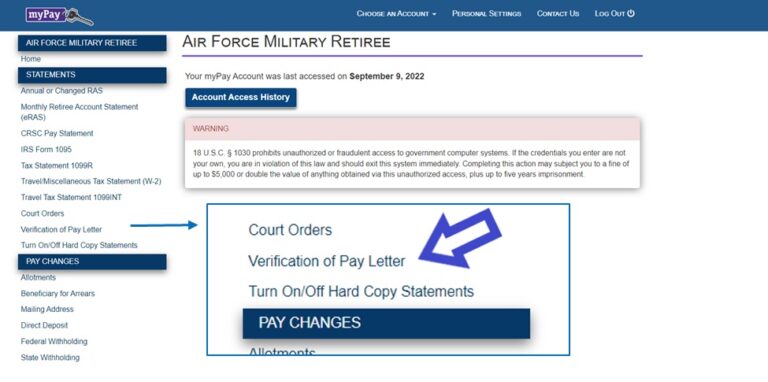

How to Change Direct Deposit Information with DFAS

Direct deposit allows military personnel and federal employees to have their paychecks deposited electronically into their…

How to Change Your Military Direct Deposit Information

Managing finances is a critical aspect of military life. A key component of financial management for…