Wondering how to change your direct deposit info on H&R block? I’ve sorted this for you!

Here are the basic steps for changing direct deposit for H&R block:

- Log in to H&R Block Online.

- Choose the filing method and select Direct Deposit.

- Enter and confirm new bank account and routing numbers.

- Review direct deposit info on the filed return.

- Call the IRS to change info if not processed or request a check is processed.

In this blog, I’ll help you find out how to tweak your vital direct deposit information on the H&R block platform. So, let’s get started!

What You’re Going to Need

Ready to switch things up? Here’s what you’ll need to make some changes to your direct deposit info on H&R Block:

- Your login credentials for H&R Block Online (psst, don’t tell anyone!)

- Details of the changes to be made

- Your previously filed tax return, if applicable

- Access to a phone to call the IRS, if necessary

Don’t worry. You don’t have to shout from the rooftops. Just use your phone to call the IRS if necessary. But if you want to celebrate, get your tax sorted and celebrate!

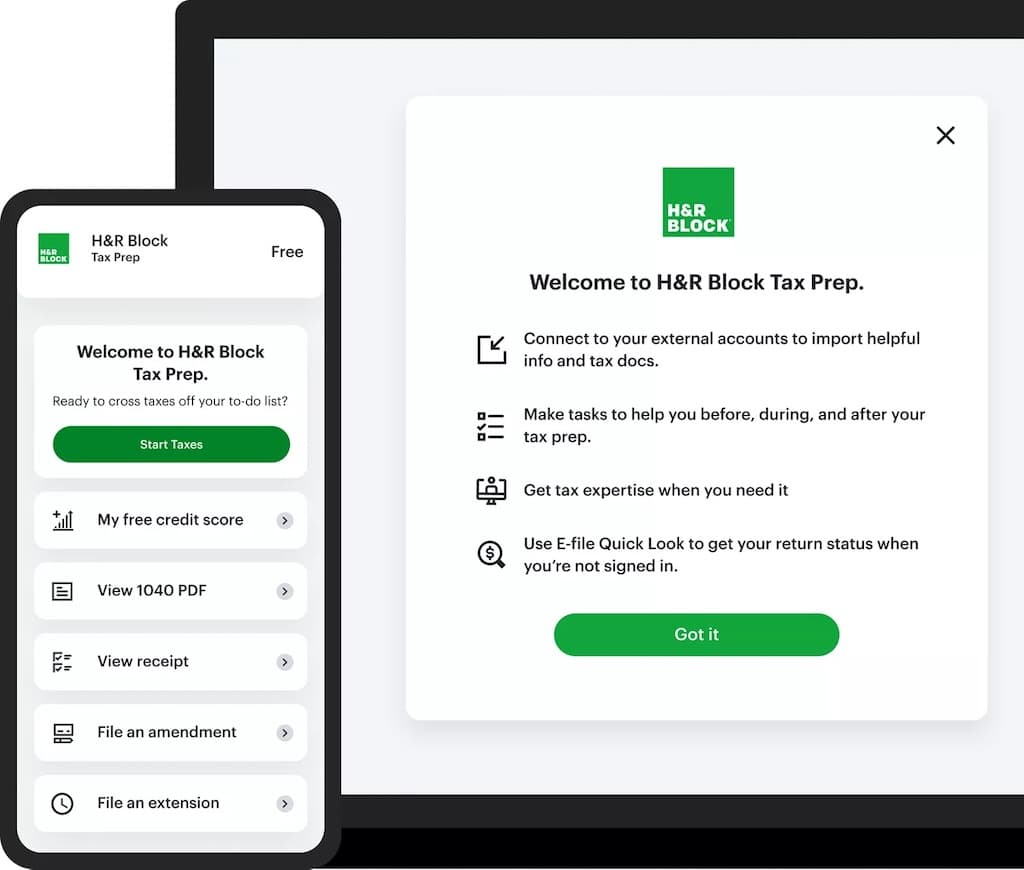

Step 1: Log in to H&R Block Online

To begin changing your direct deposit information, the first step is to log in to H&R Block Online.

Time to sort your stuff and show off those login credentials! Already have an account? Awesome – enter your username and password to get in the door.

Don’t have an account yet? No sweat. Just provide a few details like your name, address, social security number, and email address to create one.

Now it’s time to get down to business. Depending on whether you’ve already filed your tax return or not, you’ll be guided to the relevant section of the platform to make your direct deposit changes.

Tip

Get your calculator game on point, review your tax refund status, and wait for it… get expert tax advice from their rockstar team of professionals! It’s like having your very own tax superhero squad at your fingertips.

Step 2: Go to the File Section and Select Direct Deposit

Now, it’s time to make some changes to your direct deposit information. Head to the File section and get ready to shake things up by selecting Direct deposit!

Welcome to the land of options! The File section is where you get to choose how you want to file your tax return. It’s like being in a candy store, except the candy is tax forms. Choose wisely, and you’ll be rewarded with refunds.

Now, let’s talk about refund methods. You want your refund, and you want it now, right? Select Direct Deposit to have your refund transported straight into your bank account.

Step 3: Enter and Confirm New Information

Here’s where you enter and confirm your new deets, including your sizzling hot bank account and routing numbers. These digits are like the GPS for your tax refund, guiding it safely to your account.

Attention to detail is key when it comes to your banking info. Don’t let a small mistake send your refund on a wild goose chase! Double-check that your new bank account and routing numbers are accurate and match the deets on your account. No typos allowed!

Tip

Once you’ve entered your new bank account and routing numbers on H&R Block, don’t hit that submit button just yet. Take a deep breath and confirm them like a boss. This simple step will give you peace of mind and prevent any oopsies along the way. Let’s get that refund where it belongs!

Step 4: Review Direct Deposit Info on a Filed Return

Time to put your detective hat on! This step is all about reviewing the deets on your old tax return. This is your chance to make sure that your new bank account and routing numbers match the old ones you gave to the IRS.

You’ll need to access a copy of your tax return. Just log in to H&R Block Online or grab a physical copy. But make sure you’re checking the correct year, or you might end up scratching your head over a different set of numbers.

So, why is this checking thing so important? Well, if the direct deposit info on your old return is outdated or just plain wrong, it could explain why your refund went missing or ended up in the wrong account. And let’s face it. Nobody wants that kind of surprise. So, take the time to make sure your info is up-to-date and accurate, and you’ll be one step closer to a successful refund.

Step 5: Call the IRS to Change Info if Not Processed or Request a Check if Processed

So, you messed up your bank deets? Don’t worry, just give the IRS a ring at 800-829-1040, and they’ll sort you out with a change to your direct deposit information.

And if you’ve erred in entering the wrong bank account or routing numbers on your tax return that the IRS already accepted, it’s time to call the IRS directly to request a change to your direct deposit info.

To make the change after your tax return has already been accepted, you need to ring up the IRS at 800-829-1040. They’ll grill you on some questions to confirm your identity. They’ll ask for your name, social security number, and birthdate.

Once verified, you can ask to change your bank account and routing numbers for direct deposit. Just keep in mind that if the IRS has already sent your refund to the wrong bank account, they might be unable to switch it up.

If the bank bounces back your refund due to the wrong bank deets, the IRS will send a paper check to the address on your tax return. Or you can also request a paper check instead of a direct deposit over the phone.

Final Thoughts

Changing your direct deposit information on H&R Block Online is a simple five-step process that saves you time and gets your refund where it belongs. Double-check your new banking information, review your old tax return, and call the IRS if needed.

And don’t forget, H&R Block’s team of tax superheroes is there to provide expert advice and assistance along the way.