TurboTax is one of the most popular tax software on the market, but how long does it take them to give you your well-earned refund?

How long does a TurboTax direct deposit take? The TurboTax direct deposit usually takes about 21 days. You should receive a notification from TurboTax or the IRS once your refund is direct deposited into your bank account.

The fastest way to get your tax refunds from TurboTax is to choose the “e-file” option and select “Direct Deposit.”

You can start checking your account 24 hours after filing, and the refund should reach you within 21 days.

Why Does It Take So Long?

After reading that, you may think that 21 days is a long time to wait. When you file using tax software like TurboTax, you indirectly submit your taxes to the IRS. The IRS still has the final say on if everything is correct or not.

Before you start thinking that sending it through the mail might be faster, e-filing is more effective than submitting a paper document for many reasons.

One reason is that you are not beholden to the post office; please get tracking and confirmation if you want to send your tax forms through the mail!

Another perk is that e-filing is much more direct; things are entered into the system immediately instead of waiting for the mail.

So, the taxes go from you to TurboTax, then to the IRS. The IRS then has to make sure everything is correct before issuing your refund.

E-filing of any kind takes up to 21 days due to the sheer amount of documents the IRS has to handle.

In other words, it’s not TurboTax’s fault that e-filing takes 21 days. It’s the same for any other service that does e-filing because the IRS is in charge.

Regardless of which service you use to e-file, you are looking at the same wait time and a longer wait (42 days) if you decide to file via snail mail.

How Much Does TurboTax Cost? What Else Does It Do?

You are probably aware that TurboTax is a popular tax software in the United States. Along with tax refunds, it can do all of the following:

- State taxes

- Federal taxes

- Customer support

- E-filing

- Stocks

- Property taxes

- Crypto

- Independent/small business forms.

TurboTax lets you do all of your tax forms, including tax refunds, completely paperless. Bolded features are locked behind paywalls.

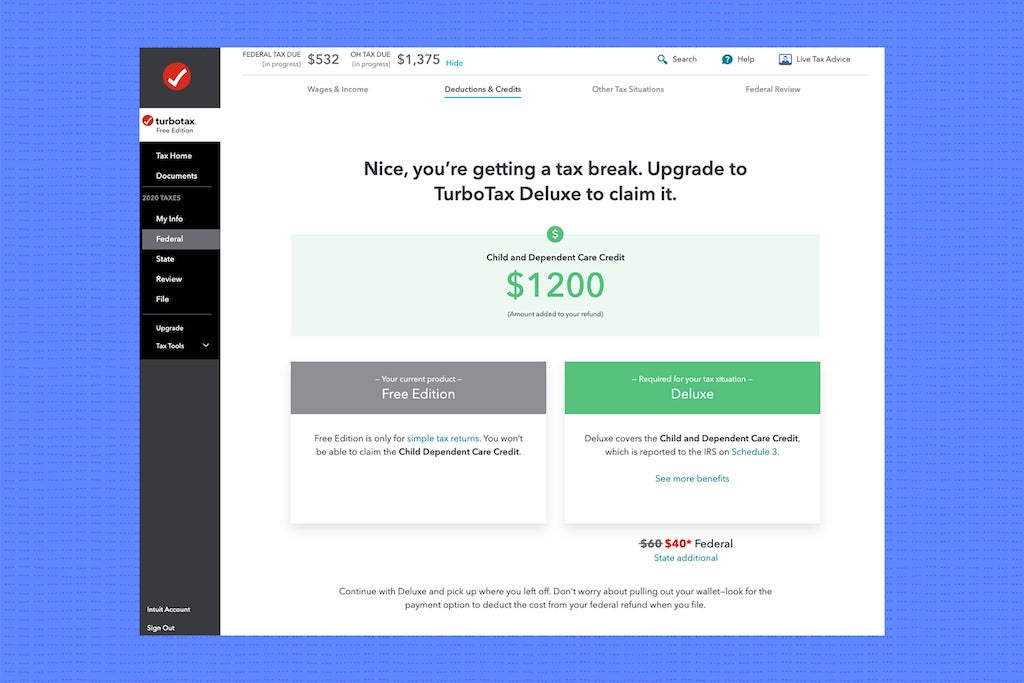

TurboTax comes in both free and paid versions. You can fill out many of your taxes online with no hassle. According to TurboTax’s official site, payment plans are structured like this:

| Plan | Features | Price |

| Free | W-2, EIC, child tax credits, customer support, e-filing. | $0 |

| Deluxe | The above and property taxes, credits and deductions, and donations. | $59 |

| Premier | The above and rental properties, stocks, and cryptocurrency. | $89 |

| Self-Employed | The above and specialized advice for independent contractors/freelancers/small business owners, industry-specific tax breaks. | $119 |

E-filing is part of the most basic TurboTax plan. This means that TurboTax sends your files to the IRS so that you don’t have to. But that does not reduce the officially-stated wait time of 21 days.

Does TurboTax Cover My Country?

Visitors from other countries may be wondering if they can use TurboTax. Due to the staggering variety of tax forms found in different countries, TurboTax only serves Canada and the United States. It does not handle forms for illegal aliens/non-residents of the United States.

However, if you are a U.S. citizen living abroad (for, say, a job), TurboTax may still be of use to you. TurboTax can handle some of the split taxes that U.S. citizens will eventually have to pay. They have more details on it here if this situation applies to you.

How Do I Check the Status of My TurboTax Refund?

TurboTax makes it very easy for you to check the status of your tax refund. If you chose to e-file, check this webpage and follow the instructions. The information should show up on your account.

It takes such a long time because the IRS has to approve your refund. Be patient; they’re overworked, understaffed, and don’t have cutting-edge technology to do their extremely important job. If TurboTax’s tracking is not enough, the U.S. Government’s official website has ways to track your refund, too!

What If I Don’t See My Refund?

What if you’ve waited for 21 days, and still do not see your tax refund? If you still don’t see your tax refund after 21 days (remember, be patient!), it is probably still waiting for its turn in line. The IRS has to work with thousands of tax forms every day.

But if you are still concerned after those 21 days are up, please call 1-800-446-8848. TurboTax’s customer service will help you with any lost funds. Many customers see TurboTax’s non-automated customer service as worth the price of premium packages.

Conclusion

TurboTax makes filing taxes easy. If you file your taxes using TurboTax’s e-file, it’s easy to track your tax refund, too! Your tax refund should not take more than 21 days to get into your bank account if you file electronically. If you filed using TurboTax, and still have not seen your refund, please contact customer service. The sooner they know of your problem, the sooner they can fix it!

Also, bear in mind that the time it takes to e-file is not entirely in TurboTax’s control. They send your tax forms to the IRS, which has to send the forms through their system. Any mistakes will make your tax refund take longer, so it’s worth getting it right the first time!