Direct deposit allows military personnel and federal employees to have their paychecks deposited electronically into their bank accounts. This convenient method eliminates the need to deposit paper checks and ensures timely access to funds. The Defense Finance and Accounting Service (DFAS) handles direct deposits for military members and certain federal employees. Individuals can easily manage their direct deposit details through the DFAS website.

This article outlines the straightforward process of updating one’s direct deposit information online using a DFAS account. It covers the steps involved, including logging into your account, navigating to the direct deposit section, entering new bank details, confirming the changes, and submitting the request.

The article also provides guidance on what banking information is needed, troubleshooting problems, timelines for changes to take effect, setting up multiple deposits, and allowing others to make changes.

I share tips to safeguard your financial data when using DFAS services, like using secure connections, avoiding suspicious links, monitoring your account activity, and enabling two-factor authentication. With clear instructions and helpful advice, this article empowers DFAS users to seamlessly change their direct deposit details online for accurate and timely wage deposits.

How to Access Your DFAS Account Online

Online access to your DFAS account allows you to efficiently oversee your financial information in one secure place. To get started, you simply need to visit the DFAS’s official website (https://mypay.dfas.mil).

On the homepage, look for an option to ‘Sign In.’ It’s prominently located on the top of the homepage. So, it’s easy to spot. Once you click ‘Sign In,’ enter your login credentials (login ID and password).

Immediately upon entering your login credentials, you will gain access to your DFAS account, enabling you to utilize all the services available online, including change of direct deposit information.

Steps to Change Your Direct Deposit Information with DFAS

The exact steps to change your direct deposit information with DFAS are listed below:

1. Log into your MyPay account

Open the company’s official website on your web browser and enter your login details and password.

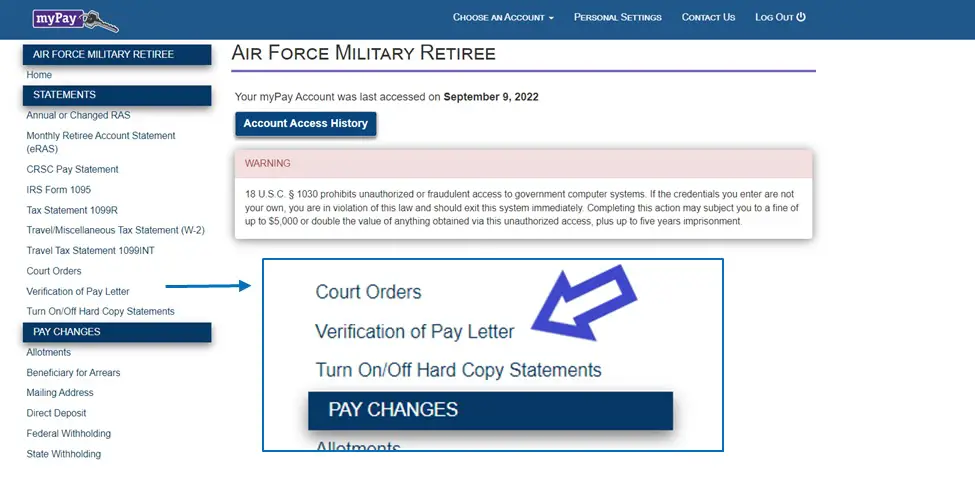

2. Navigate to the “Direct Deposit” section

Once inside your DFAS account, head to the ‘Direct Deposit’ section. On some accounts, this option will be seen as ‘Bank Information.’

3. Update your bank information

Then, proceed to the next step by selecting ‘Change Direct Information.’ This option will permit you to enter your new bank account details.

4. Confirm and save changes

Review the new bank account information for its accuracy. Then, submit the changes by clicking the ‘Save’ or ‘Submit’ button.

What Information Do You Need to Change Your Direct Deposit with DFAS?

1. Bank Name

You must furnish the bank’s name where you want your direct deposit to be routed. Specifying the bank name will ensure efficient funds transfer.

2. Bank Routing Number

The bank routing number is a unique nine-digit number used to identify the financial institution or bank where your bank account is held, allowing secure transfer of funds.

3. Bank Account Number

To proceed with the direct deposit change request, you must supply your bank account number because it will identify you with the account.

4. Type of Account (Checking or Savings)

The account type helps to distinguish between a savings and a current account. It dictates how the deposited funds will be utilized, whether for savings or business purposes.

What Should You Do If You Encounter Problems Changing Your Direct Deposit Information?

While changing the direct deposit information on DFAS is a fairly simple process, some people can still run into issues along the way. Let’s learn what you should do when you encounter a problem.

- Check whether your direct deposit account is in good standing or not.

- If the issue is with your bank, contact the financial institution to resolve it.

- Cross-check the account number, routing number, and other information pertaining to direct deposit account change.

- You can reach out to DFAS directly to discuss how they can help you resolve the issue you are encountering.

- In the event the issue remains unsolved, follow up on a regular basis until you get a satisfactory resolution.

- Another option is to escalate the matter to connect with somebody who holds higher authority, which can often expedite the entire process.

Ideally, you must document everything related to the matter to provide evidence of your actions. When you have a clear record of your actions, you can conveniently provide necessary evidence during follow-ups.

How Long Does It Take for Changes in Direct Deposit to Take Effect?

Depending on your specific situation, the changes may take one to two payment cycles. This is because many organizations have their own payment processing schedule. If you don’t make the changes before their established deadlines, you will have to wait till the next payment cycle for the direct deposit change to take effect.

Can You Set Up Multiple Direct Deposits with DFAS?

DFAS permits you to set up multiple accounts on their platform to ensure payment flexibility. Spreading funds across multiple accounts can help you with both budgeting and risk mitigation. It can also help you conceal certain transactions when sharing your account with someone else.

Can Someone Else Change My Direct Deposit Information for Me?

Due to security concerns, direct deposit changes should ideally be initiated only by the account holder. However, it’s possible to authorize someone to make the changes on your behalf. Nevertheless, it’s important to exercise caution when providing such authorization, given the significant security complications. When you authorize someone, you should also make the person understand their scope of authority.

Tips for Safeguarding Your Personal Financial Information When Using DFAS Services

When using the DFAS services, you can fortify the security of your personal financial information by following the pointers given below:

Use Secure Connections

Prioritize using the DFAS platform through a secure and trusted Internet connection. Since Wi-Fi connections found in airports, coffee shops, and other public places are less secure, the chances of data interception are high. In short, avoid using public Wi-Fi as it presents a significant security risk.

Avoid Opening External Links

You should also avoid opening external links to update your financial information on DFAS. Often, phishing links are sent to scam people into giving away their sensitive information. If you cannot trust the source of the link, stay away from it. Also, refrain from downloading anything that you don’t trust.

Keep Monitoring your Account

There is no substitute for proactive account monitoring to mitigate the risk of financial fraud. You need to regularly monitor your account activities to identify any suspicious activity. If you notice anything unusual, you must change your account password as soon as possible. You must also report the issue immediately.

Activate Two-Factor Authentication

For added financial security, DFAS lets account holders set two-factor authentication. The two-factor authentication involves an extra layer of authentication, often in the form of code sent to users via phone or text message, making it significantly difficult for unauthorized individuals to gain access to someone’s account.

Set up Security Alerts

As a part of their efforts to enhance personal financial security, DFAS also provides security alerts. These alerts serve the purpose of promptly informing the users about any noteworthy alterations or activities taking place in their accounts. Basically, the alerts serve as an early warning to respond quickly to unauthorized activities.