To change the direct deposit account information with your new bank details, follow these steps on the Paycor platform.

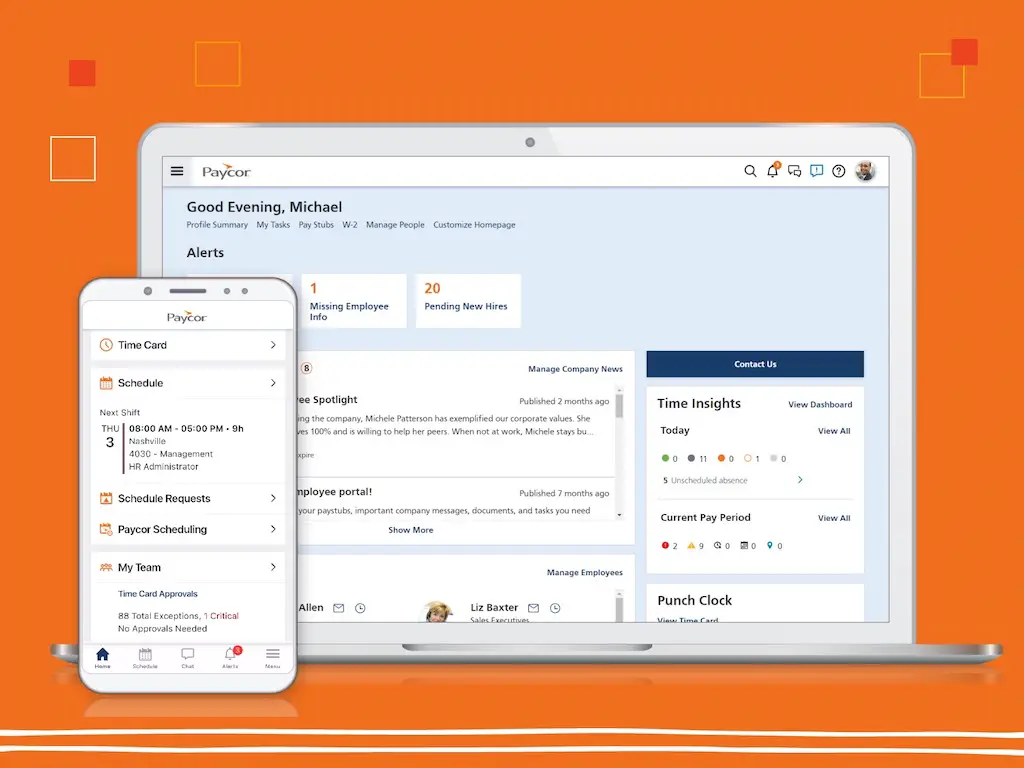

1. Log into Your Paycor Account

To access your Paycor account, visit www.paycor.com. On the login section of the website, enter your username and password.

If your account is activated for two-factor authentication, the system will prompt you to enter a ‘code’ sent to your updated email address or mobile number.

2. Select the “Tax & Pay” Option

Once logged in, look for the ‘Tax & Pay’ option on your account dashboard. This option will be located on the top left of your screen. That said, the exact location may vary depending on the Paycor version in use.

3. Select the “Direct Deposit” Option

Within the ‘Tax & Pay’ option, you will see the ‘Direct Deposit’ tab to make changes to your bank account.

4. Enter Your Bank Account Information

Once you click on that, you will be redirected to a new page to enter your bank account details.

5. Confirm Your Bank Information

Double-check the entered information to ensure its accuracy before submission.

6. Submit Your Request

After verifying the information, submit the direct deposit change request by clicking the ‘Save’ or ‘Submit’ button.

7. Check Your Paycor Account for Changes

Paycor may send notifications regarding the recent change. You can also visit the ‘Direct Deposit’ section to see the new information.

What Are the Benefits of Direct Deposit on Paycor?

It’s convenient for the employees because they get faster access to funds. Moreover, they don’t have to visit the bank or worry about receiving paper checks, which can get lost or damaged during transit.

Organizations can benefit, too, as they won’t have to send out dozens of physical paper checks. Since the process of direct deposit payment on Paycor is more streamlined, it also helps maintain proper records.

What Are the Requirements to Change Bank Account Information on Paycor?

The following are the common requirements to change bank account information on Paycor.

Bank account information

You must provide a valid bank account number for direct deposit use on Paycor.

Authorization

You must also send a written authorization letter to consent to a change in your bank account information.

Approval

Depending on your organization’s policy, you might have to get the direct deposit account change verified and approved by the payroll team.

Documentation

In some cases, you may be asked to provide supporting documents to confirm the validity of the new bank account information.

Test Payment

Some organizations may send a test payment to the new account. You should be willing to approve the test transaction.

What Are the Advantages of Using Paycor for Direct Deposit?

There are many striking advantages of using Paycor for direct deposits.

Safety

Funds transferred through direct deposits on Paycor are more secure in nature.

Accuracy

Because of minimized errors in payment processing, Paycor direct deposit payments are more accurate.

Automation

Since the payroll process is online and automated, it eliminates or reduces the need for manual tasks.

Payment Splits

Paycor allows to split direct deposit payments, offering employees the flexibility to manage their finances better.

Environmental-friendly

Because direct deposit payments are paper-free means of transaction, they contribute to environmental sustainability.

Record keeping

Paycor makes record-keeping fast and easy. They provide reports of all the payroll transactions.

Customer Support

Paycor has an awesome customer support team to help you with any direct deposit queries.

How To Protect Your Financial Information with Paycor?

Since sensitive data gets shared, protecting financial information becomes important on any online platform, including Paycor. Let’s see how to protect your financial information with Paycor.

Set a Strong Password

Make sure not to use easily guessable passwords. Create long passwords with a varied mix of characters. Also, keep changing your password now and then.

Opt for Two-Factor Authentication

To enhance the security of your sensitive information, enable two-factor authentication, which will require a person to enter a verification code for account access.

Keep Monitoring

It’s a good idea to keep monitoring your account for suspicious transactions so that you can report unauthorized account access at the earliest.

Stay up to date

As much as possible, educate yourself about online security concerns and how to deal withthem. Regularly read informative guides on fraud prevention.

What Are the Steps to Re-Verify Your Bank Account Information on Paycor?

-Login to your Paycor account with the login credentials.

-Look for the section related to finances (payroll, direct deposit).

-Within that tab, you will see your existing bank account details.

-Look for the ‘Update Bank Account’ or ‘Re-Verify’ tab.

-Fill out the new banking details on the screen.

-Provide the missing information if you receive an error.

-When prompted, confirm the submitted information.

-Provide necessary documentation, if requested.

-Follow the prompts to save or submit the changes.

-Wait for the confirmation notification.

-Inform the HR/Payroll department of the account change.

What Are the Different Types of Direct Deposit Payments on Paycor?

Depending on your company’s specific Paycor configurations, the following different types of direct deposit payment options are available on Paycor to accommodate different needs and employee preferences.

Regular Direct Deposit

Under this payment option, the entire payment will be transferred directly to the designated bank account.

Split Payments

This payment option allows employees to get deposits in more than one bank account according to their specific needs.

An employee can allocate a certain portion or percentage of the pay into each of the accounts.

Balance to Zero

The ‘Balance to Zero’ direct deposit option allows employees to allocate their direct deposit payments toward specific expenses.

The payroll system will automatically allocate necessary funds from the deposits to cover all the designated expenses.

Prepaid Cards

Paycor may disperse payment into prepaid cards in certain scenarios. The wages will be loaded into the prepaid card.

Tax Refund

Paycor allows employees to set up direct deposit preferences for tax refunds. A separate bank account can be allocated for tax refund purposes on Paycor.