Getting your refund quickly and securely means your bank account details need to be up-to-date. This guide provides a comprehensive walkthrough on how to change your direct deposit information on TurboTax, so you can receive your refund without any hiccups.

Why Update Your Direct Deposit Information?

Incorrect banking information can lead to delays in receiving your tax refund, or worse, your refund could end up in the wrong account. Whether you’ve switched banks, opened a new account, or simply need to correct an error, it’s essential to verify and update your direct deposit details on TurboTax.

Before You Begin

- Gather your new bank account information: You’ll need your bank’s routing number and your account number. Ensure you have these details handy before starting the process.

- Access to TurboTax: You’ll need to be able to log in to your TurboTax account.

- Timing: You can only change your direct deposit information before your return has been accepted by the IRS. If your return is already accepted, it’s too late to make changes.

Step-by-Step Instructions

- Sign in to TurboTax: Go to turbotax.intuit.com in your web browser and sign in to your account using your correct login details.

- Navigate to the File Section: Once logged in, find the “File” section. This is where you’ll manage your tax return and refund options.

- Start or Revisit Your Refund Options: In the File section, look for the option related to your refund, such as “Start,” “Revisit,” or “Continue” next to Step 2 Your refund/payment info. Click on it to proceed.

- Choose Direct Deposit: On the Get your refund up to 5 days earlyscreen, select “See all options”. Then, choose the “Direct deposit” option.

- Enter Your New Bank Details: You’ll be prompted to enter your bank account and routing numbers. Double-check that you are entering the correct information. Errors can cause delays.

- Review and Confirm: Carefully review all the details you’ve entered. Make sure the account number and routing number are accurate.

- Save Your Changes: After reviewing, save the changes. Look for a “Continue” button or a similar option to finalize the process.

- Final Verification: During the final review, verify the last four digits of your account number to ensure accuracy.

Troubleshooting Tips

- Routing Number Errors: If TurboTax flags your routing number as incorrect, try manually typing the numbers instead of copying and pasting. Some users have found this helps resolve the issue.

- Return Already Filed: If you’ve already filed your return and it has been accepted, you cannot change your direct deposit information through TurboTax. In this case, you may need to contact the IRS directly.

- IRS Contact: If your refund hasn’t been posted yet and you entered incorrect information, call the IRS at 1-800-829-1040 to stop the direct deposit.

What If Your Return Has Already Been Accepted?

If your return has been accepted, you won’t be able to change your direct deposit information through TurboTax. In this situation, here are a few steps you can take:

- Contact the IRS: Call the IRS immediately to inform them of the incorrect banking information.

- Incorrect Account Number: If the account number you entered belongs to someone else and the bank accepts the deposit, you will need to work directly with that bank to recover your funds.

- Refund Trace: If your refund goes to the wrong account, you can contact the IRS to request a trace on the refund.

Additional Considerations

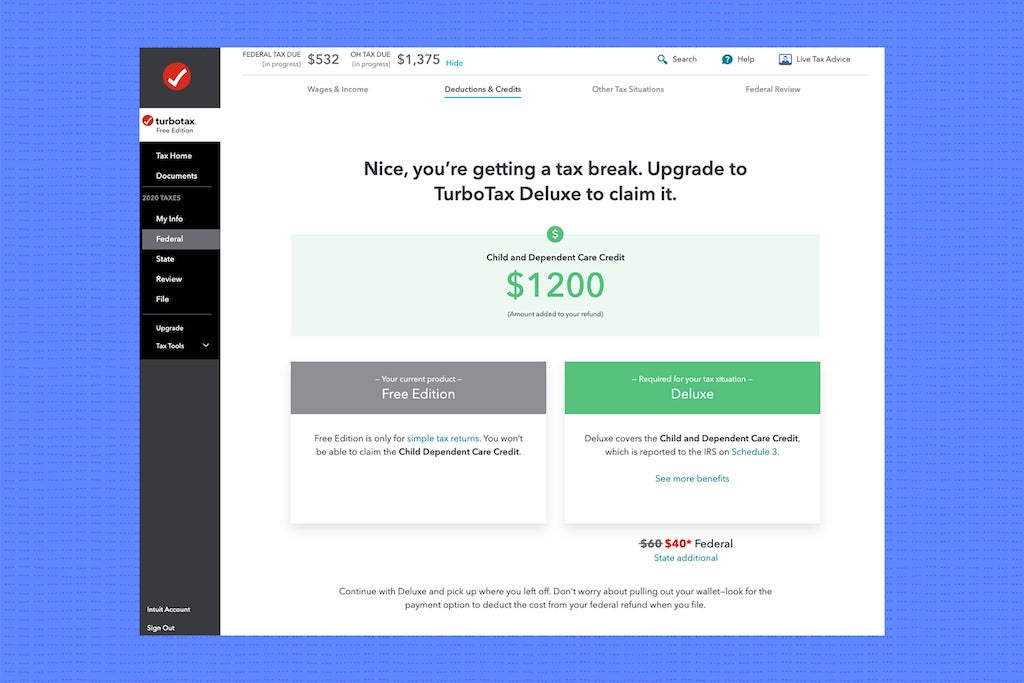

- Fees: Be aware of any potential fees. If you choose to have your TurboTax fees deducted from your refund, an additional processing fee might apply.

- Screenshots: It’s a good idea to take screenshots of the confirmation page showing your new banking information for your records.

Conclusion

Changing your direct deposit information on TurboTax is a straightforward process that ensures you receive your tax refund quickly and securely. By following these steps and double-checking your information, you can avoid potential delays and complications. Always ensure your banking details are accurate and up-to-date before filing your return.